Benefits and Pitfalls of Buying Property in Florida 2022

May 23, 2022

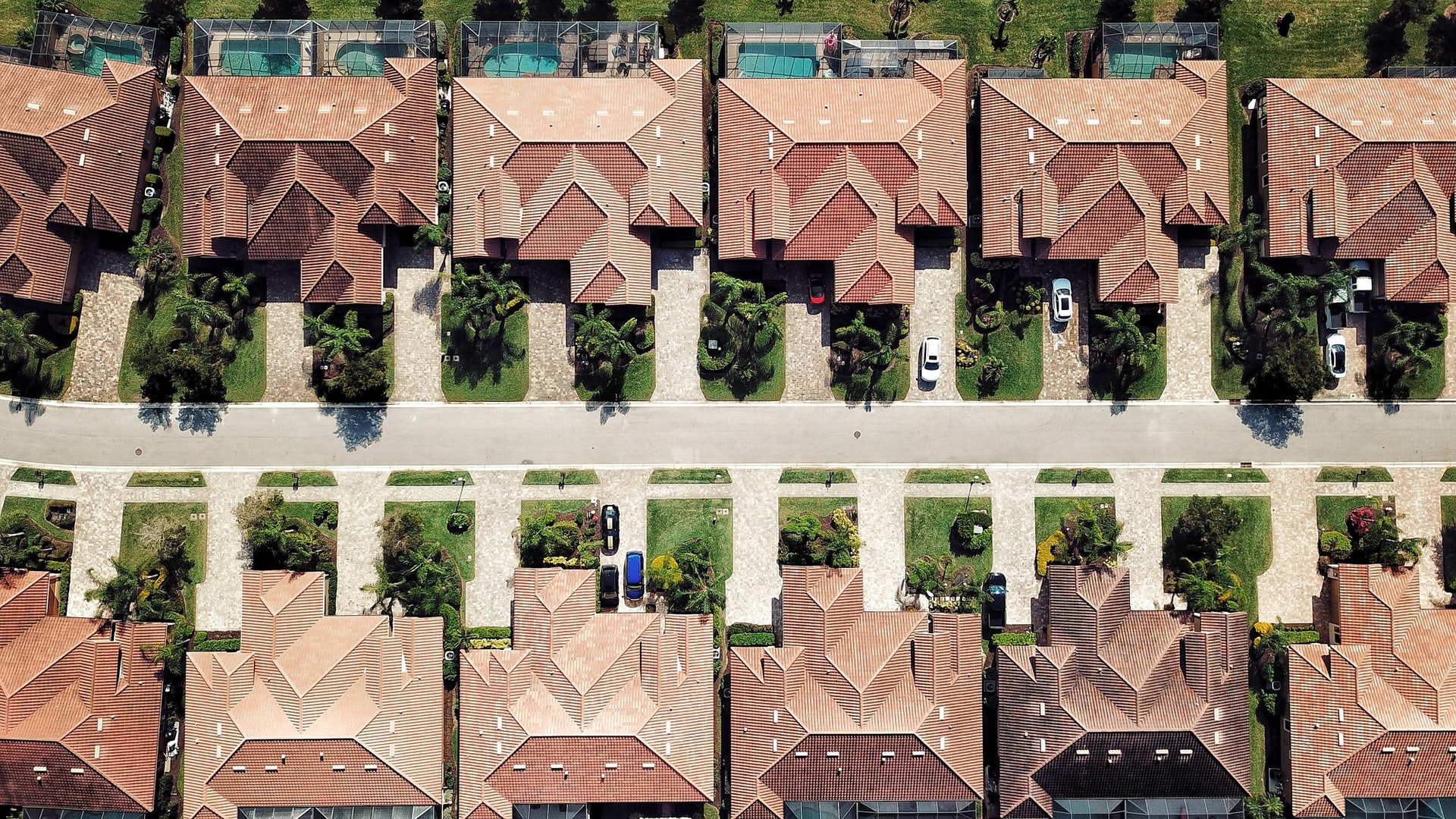

Florida is one of the most popular places in the US to move to. Many people look to Florida as a great place to move to because of the weather and lifestyle. However, many buyers are looking to Florida as a great place to purchase a vacation home or make a real estate investment. Between home buyers looking to settle down, retirees, real estate investors, and those looking to get out of their state, Florida has much more buyers than sellers.

Buying a house in Florida has become fast-paced because of the competitive seller’s market. Yet, many people are still pursuing the idea of buying a house in Florida for the first time. If you are considering purchasing a house in Florida, it is important to be aware of the pros and cons. Here are the current benefits and pitfalls of buying property in Florida.

Buying a House in Florida: The Pros & Cons

The Benefits of Buying Property in Florida

Just like with any decision, there are many pros and cons to buying a house in Florida. But, buying a house is a lot more costly and consequential of a decision to make than most others. While Florida has its fair share of negatives, there are also many positives about moving to the Sunshine State.

1. Mortgage Rates Are Low But Rising

Mortgage rates have been at historic lows for years now, but with inflation on the rise, it looks like mortgage interest rates will rise as well. The average rate for a 30-year fixed-rate mortgage across the nation is currently 5.42%. In Florida, the mortgage rate is at 5.125%, according to US Bank. Historically, the current mortgage rates are still lower than they ever have been but that might change in the future.

The Fed is raising its interest rates to combat inflation and as a result, experts predict that mortgage rates will increase alongside the Fed’s target rate. Mortgage rates are still low currently but there’s no telling how much The Fed will have to raise its rates to stop inflation.

Read More: Here Are The Best Cities To Live in Florida

2. Renting is Getting More and More Expensive

If you are looking to or already live in a rental in South Florida, then you know how expensive it can be. The prices of rentals has increased dramatically over the past year and has pushed many renters out of the area. Realtor.com released new data that revealed that the rent in South Florida increased by 50% in the last year. NBC Miami reported that a studio apartment priced at $1,500 a year ago is now $2,300 now. The reasoning behind these price hikes is still being debated but what is certain is that the extremely high demand has played a vital role.

Depending on your long-term plans, buying a property in Florida may be a better option than continuing to rent. Mortgage rates are still low and there are many perks to homeownership. However, rentals are flexible whereas mortgages aren’t so make sure to consider all your options before making a decision.

3. Potential For Investment

The Florida Housing Market is one of the strongest markets in the country and has been for a few years now. The state’s population is constantly growing as more people move from all over the world. Many real estate investors are looking to Florida as a place to invest in property because of the potential for appreciation and the opportunity to rent out the properties for extra income. The prices for houses continue to rise which makes Florida a great place to buy a house and allow it to appreciate.

Read More: Is Buying a Beach Condo a Good Investment?

The Pitfalls of Buying Property in Florida

The Florida market in 2022 is a seller’s market which means that there is more demand for houses than there is supply. This gives the seller a lot of power in the negotiation process and often leads to an extremely competitive market for home buyers. Here are some more cons to keep in mind if you’re considering purchasing a house in Florida.

1. Home Buyers Are Paying More Than Needed

In a seller’s market, the market is extremely competitive and as a result, home buyers often end up paying more than they need to. Home buyers are known to bid over the asking price in a seller’s market by a substantial amount. In Florida, houses have been selling for thousands over asking price and sometimes over a hundred of thousand. Buying an overpriced house or being forced to bid too much over asking can pose a problem if the housing market were to ever change drastically or crash.

2. Experts Are Predicting a Recession Soon

Inflation has caused many prices to increase from gasoline to food. On top of that, the stock market has been on a downward spiral since the beginning of 2022. Both of these factors and more are leading economists to predict a recession in the near future. A recession would mean that people have less money to spend, jobs are lost, and the housing market would be greatly affected. Property values would likely decrease in Florida and selling a house during a recession for a profit is a lot more difficult.

3. Cash Buyers Are Getting Prioritized

Florida has had a boom of cash buyers that can close on a house faster than traditional types of buyers. Many home buyers have reported their experience of being a top-choice for a certain house on sale only for a buyer with cash to swoop in and purchase the property right before them. However, most home buyers don’t have cash on them to buy a house. If you’re not a cash buyer, you may find yourself at a disadvantage when trying to purchase property in Florida.

4. There Are a TON of Investment Properties in Florida

Florida is a very popular place for vacationers and snowbirds. As a result, there are a lot of investment properties in Florida that people purchase for the sole purpose of renting it out. Part of the expectation of being a homeowner is living in a a quiet neighborhood. Homeowners have had unpleasant experiences living next to Airbnbs where people are constantly coming and going at all hours of the night.

There is also a problem where investment firms from out of state are purchasing properties in Florida at an increased rate. Home buyers may experience a problem bidding against firms and hedge funds that have more money and can pay in cash.

Consider The Location and Your Reasoning For Moving To Florida

Florida has a lot of properties all throughout the state. It’s important to pick a location that you see yourself being content with for a while. South Florida may be a popular destination for buyers, but there are many other locations that may better fit your needs such as Central Florida or North West Florida. Picking the right city or neighborhood is especially important if you have a family. The school system, the crime rate, and other demographics should all be taken deeply into consideration.

The reasoning for your move to Florida is also important. Many people move to Florida because they enjoyed their vacation in the Sunshine state or they believe they will enjoy the ideal Florida lifestyle. However, many homeowners are surprised to learn about the reality of living in Florida when it comes to the weather, the cost of living, HOAs, and other things.

It’s important to move to Florida for the right reasons so you’re not caught off guard or disappointed with your decision later on down the road. You are the only person who can properly assess your reasoning and circumstances to determine if moving to Florida is right for you.

A Great Real Estate Agent Makes Buying a Home in Florida Easier

In the fast-paced and turbulent housing market like Florida’s, finding a house and closing on it quickly is difficult. There are already a lot of things to consider before buying a house (closing costs, the neighborhood, the state of the property, etc.) without even thinking about the challenges that come from buying a house in a quick and competitive market like Florida.

A great real estate agent that has the expertise to navigate the local market can help buyers immensely by doing a lot of the work for them. A great agent will also have a large network of other agents, know about houses before they are even listed on the market, and understand all of the ins-and-outs of buying a house in Florida.

However, not all real estate agents are great. Many agents are simply average or even bad at their jobs. Luckily, we have created a real estate organization that streamlines your search for a high-quality real estate agent otherwise known as a Negotiator. Negotiators are real estate agents that have all proven themselves to be top performers in their local real estate markets. By hiring a Negotiator, you’ll have someone on your side who has a wealth of experience, real estate expertise, and an unrivaled work ethic working to get you the best deal possible.

Contact your local Negotiator if you want to work with a great real estate agent.